For years, Garmin users enjoyed a “buy once, own forever” relationship with their hardware. Unlike competitors who locked advanced metrics behind paywalls, Garmin provided a robust, free ecosystem. However, the introduction of Garmin Connect Plus marked a fundamental shift in this philosophy. Despite initial pushback from loyalists, recent financial indicators suggest that Garmin’s gamble on recurring revenue is paying off.

Breaking the Unspoken Agreement with Users

The launch of a paid tier was met with skepticism, largely because Garmin devices are already positioned at a premium price point. Historically, there was an implicit understanding that the high cost of the watch covered the lifetime of the data analysis and software features.

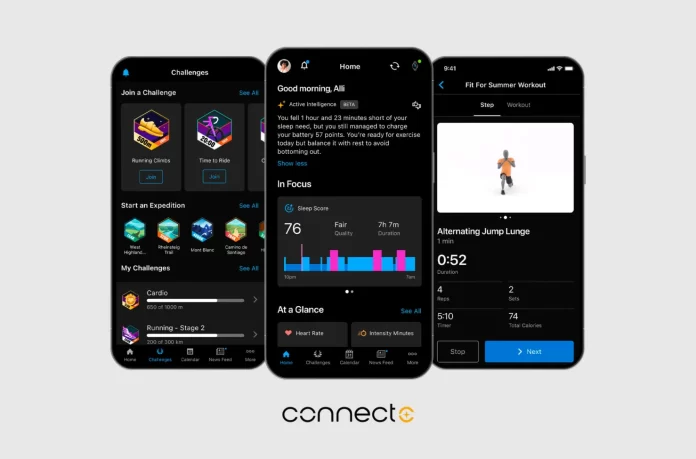

By introducing Connect Plus, Garmin moved the goalposts. New features—particularly those powered by artificial intelligence—are no longer being added to the free tier. Instead, they are being utilized as incentives to drive users toward a monthly commitment, changing the brand’s identity from a pure hardware manufacturer to a service-oriented tech firm.

What Lies Behind the Garmin Connect Plus Paywall?

Garmin hasn’t just added a fee for existing features; they have built a suite of new tools designed to appeal to data-hungry athletes. Key components of the “Plus” experience include:

-

Advanced Nutritional Tracking: Users can now log meals via their camera and receive AI-driven dietary insights.

-

The Performance Dashboard: A highly customizable interface that allows for granular data visualization and custom charting.

-

AI-Enhanced Coaching: Personalized recommendations that adapt more fluidly to a user’s specific recovery and training loads.

Financial Momentum: Growth Beyond Hardware

The success of this strategy was recently highlighted during an investor call. CEO Cliff Pemble noted that Garmin’s subscription segment is currently expanding at a rate that matches or exceeds the company’s overall business growth.

While hardware sales still dominate the balance sheet—with subscriptions currently accounting for less than 10% of total revenue—the trajectory is clear. Between Garmin Connect Plus, Outdoor Maps Plus, and the inReach satellite communication services, the company is successfully building a diversified stream of recurring income that is less dependent on one-off device upgrades.

The Future of the Garmin Ecosystem

The “stay the course” attitude from Garmin leadership suggests that the subscription model isn’t a temporary experiment. As AI becomes more integrated into health tracking, the processing power and development costs associated with these features provide a convenient justification for ongoing fees.

For the consumer, this means the “complete” Garmin experience now comes with a secondary price tag. While the core fitness tracking remains free for now, the most cutting-edge innovations are increasingly becoming a “members-only” privilege. For Garmin, the transition from a hardware company to a digital service provider is not just a plan—it is a reality that is already showing up in their bottom line.

Also Read: Garmin’s Premium Epix Pro Gen 2 Just Hit 50% Off: Still Worth it in 2026?

Source: Investing.com